Accessing Climate Finances through the Infrastructure and Development Bank of Zimbabwe

1. What you need to know about climate change

Climate change is one of the biggest threats to Zimbabwe’s attaining Vision 2030. The effects of climate change undermine socio-economic development and increases inequality and poverty. The Infrastructure and Development Bank of Zimbabwe (IDBZ/the Bank) is alive to the ongoing global climate change discourse and is taking various initiatives to complement the Government of Zimbabwe’s efforts to achieve the transition to low carbon and climate resilient development pathways. The Bank recognizes the importance of exploring innovative approaches to promoting access to global climate finances to fund climate adaptation and mitigation projects in the country given that domestic funding sources are not adequate to meet the scale of investment required.

Zimbabwe Nationally Determined Contributions (2021) outline ambitious steps to build a climate-resilient and low-carbon economy targeting mitigation actions in Energy, Industrial Processes and Product Use (IPPU), Agriculture, Forestry, and other Land Use as well as Waste. In this regard, the IDBZ is committed to supporting the country to bolster its climate action by developing and implementing adaptation and mitigation projects through robust climate financing.

2. IDBZ initiatives to support Zimbabwe’s efforts towards the transition to low carbon and climate resilient development pathways.

2.1 Accreditation to the Green Climate Fund (GCF)

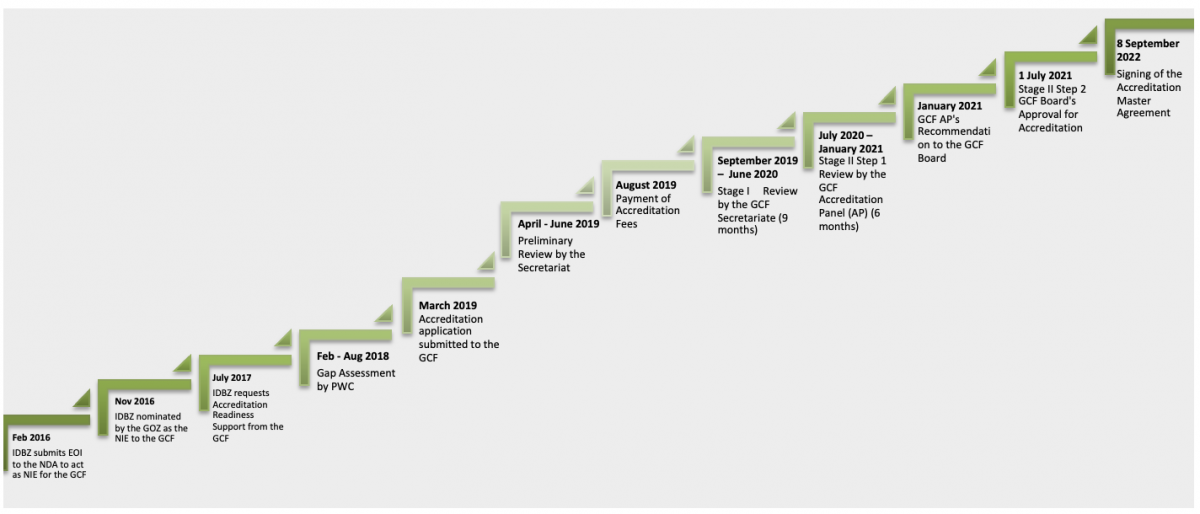

The IDBZ is an Accredited Entity (AE) of the Green Climate Fund. The Bank was accredited in July 2021, following a lengthy accreditation process.

2.1.1 Our Accreditation Journey

2.1.2. The Essence of GCF Accreditation for Zimbabwe

- Accreditation enables the Bank to access concessionary loans for implementation of climate adaptation and mitigation projects approved by the Fund.

- Adaptation and mitigation projects falling within the Banks mandate areas include:

- Climate resilient agriculture

- Renewable energy

- Integrated waste management systems

- Changing existing thermal power station technologies to low carbon technologies

- Urban public transport systems

- Private and public sector organizations in the country can also access GCF loans through the Bank as the Accredited Entity.

- The GCF offers medium to long term loans, payable over periods of 5 to 10 years. These are currently hard to come by in Zimbabwe.

- Organizations accessing GCF loans through the Bank gets technical support from the Bank during implementation to ensure projects meet both GCF requirements and project objectives.

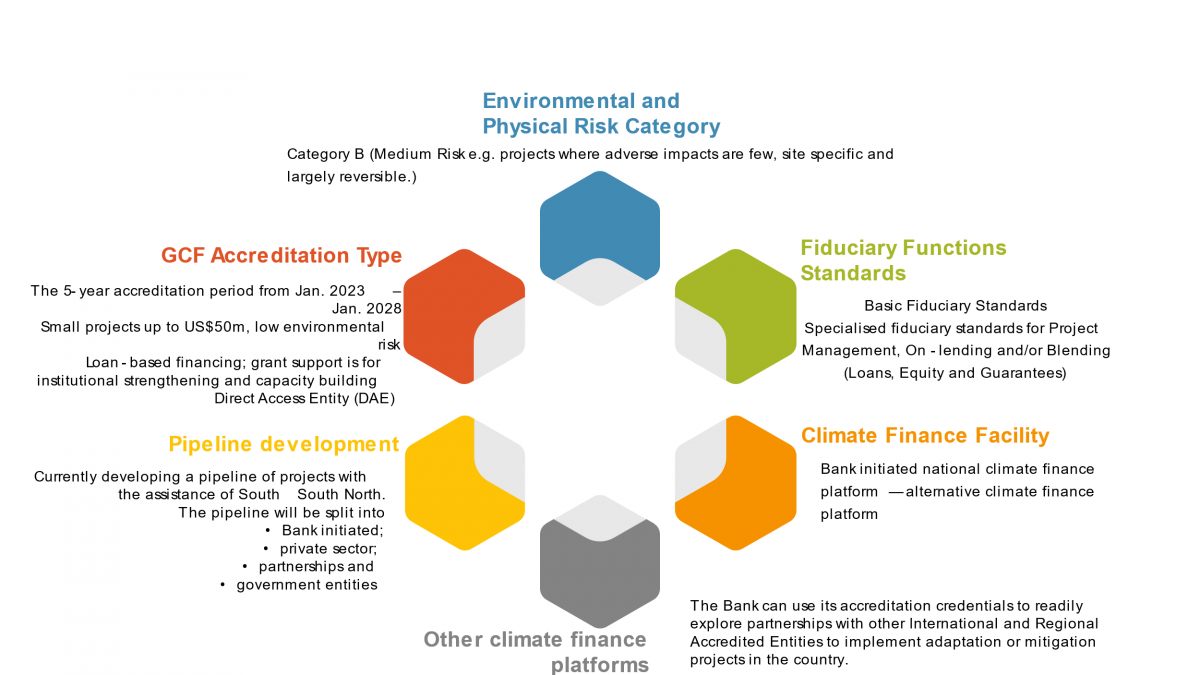

- The accreditation essence and other financing initiatives are summarised in the diagram below;

2.1.3. Processes and procedures that guide access to GCF funding

2.1.3.1. Call for proposals

The Bank will open a window for project developers to submit concept notes. The call for concept notes will be advertised through various print and electronic media platforms including national newspapers and on the Bank’s website. Information about this process will also be disseminated to Bank clients and potential project developers through stakeholder meetings.

2.1.3.2. Consideration of proposals

Concept notes will be evaluated as follows:

a) Stage 1 Review by the Bank

b) Stage 2 Submission of the Concept Note to the National Designated Authority

c) Concept Note Validation by stakeholders

2.1.3 Meeting GCF requirements

The GCF has six investment criteria which projects must comply with to access resources. https://www.greenclimate.fund/sites/default/files/document/gcf-b07-06.pdf)

All submissions will be checked against the GCF’s investment criteria; hence project developers must ensure that projects comply with the criteria. The Bank will verify compliance before concept notes are submitted to the National Designated Authority (NDA), the Climate Change Management Department.

2.2. Climate Finance Facility

The Government of Zimbabwe recognizes the important role of the Bank in mobilizing innovative and transformational financial resources towards the implementation of green infrastructure projects. In this regard, the Bank has established the Climate Finance Facility (CFF), to attract funding from various climate finance sources including national sources, the GCF and other global bilateral and multilateral climate financing institutions.

2.3. Renewable Energy Fund (REF)

The Bank as a National Partner renders technical expertise to the REF which was established under the auspices of the UN Joint SDG FUND. The REF will provide financing and technical assistance to renewable energy businesses in Zimbabwe. Through promoting investments from both public and private companies, the REF seeks to lower investment bottlenecks in renewable energy enterprises. The Fund will ensure that these initiatives are bankable and sustainable.

3. Gender Mainstreaming and Climate Finance

The Bank recognizes that climate change is not gender-neutral – it affects women and men differently with poor women bearing the brunt of its effects. Poverty, the lack of meaningful access to resources and information, and the absence of power in decision-making are the major contributory factors to the disparate vulnerability of women. To address these disparities, the Bank developed its Gender Policy and the Gender Mainstreaming Strategy and Action Plan (2020 – 2025) to guide its gender mainstreaming drive.

The strategies being employed by the Bank in the implementation of the Policy include the infusion of gender analysis throughout the project cycle and the prioritisation of investment projects that maximize benefits to vulnerable people including women and the girl child, demonstrating both a risk based and opportunities-based approach. Inclusive stakeholder engagement remains central to ensure the needs and interests of women and men, boys and girls, in their diversities are taken on board.